How will Inflation Impact the Housing Market?

Key Takeaways

- Historic low housing inventories create value in competitive housing markets.

- As some homeowners see this as the best time of year to sell, there is a 10 year high in anticipation for new listings.

- As inventory supply chain problems impact the housing market, condo and rental demand will likely rise.

The Housing Market Will See Balance in This Year

Two years of buzzing around words like “unprecedented,” “historic,” and “white-hot” for two consecutive years, it’s now possible to add “inflation” to the list.

How will inflation affect the real estate market by 2022?

The inflationary effects of a declining economy’s purchasing power are not only felt in real estate, but also in other sectors such as finance and insurance. Real estate costs rise when prices rise. This is how inflation works. Just like rising tides lift all boats, inflation also rises with rising costs. There are many reasons to feel confident about real estate’s ability to protect against inflation and make a profit.

These are some tips and details to help you navigate inflationary waters, and to better prepare yourself to make your move once you’re ready.

#1: Low Housing Inventory drives Values

The market is expected to remain undersupplied throughout this year, with historic lows in housing inventory. Supply chain issues and inflationary pressure will continue to influence the market. Analysts are expecting a modest 3% increase in home values, as opposed to the 24% return last year.

It is well-known that real estate can still be profitable even when inflation occurs. The reason landlords are able to pass on their increased costs to tenants is one. The real lesson is the old adage that scarcity creates wealth. Instead of viewing the record-low housing inventory as something to avoid, it means that there is plenty of competition for home buying. However, this is because of the intrinsic value of being a homeowner.

#2: Listings Hit a 10-Year High

In order to create more inventory, homeowners will be encouraged to sell their homes once the double-digit price increase in home values has ended. As the market stabilizes and becomes more balanced, homeowners may be more inclined to sell their homes to offset inflationary pressures elsewhere. However, it won’t be enough to meet historical demand for 2022. The increase in listing of existing homes will coincide with a slight rise in listing of newly constructed homes. This is also expected to be the most significant increase in a decade.

We expect the inventory of new homes to increase after 2021’s bottom. However, we still believe that there will be a shortage in the market. Particularly, there will be a high level of entry-level home construction.

#3: Condo and Rental Demand will Take off

2022 will see the end to mortgage forbearance. This, along with inflationary pressures will force many homeowners to rent and sell. The demand and rental prices will increase, creating opportunities for those looking to enter the housing market. Rents are expected to rise 7% by 2022, which is more than twice the year-over-year home price growth of 3%. This proves that homeownership is always a better investment and use of your money.

As the pandemic ends, more people will move to cities where renting is again more common. Many movers will be able to explore their new home before they decide to buy a house.

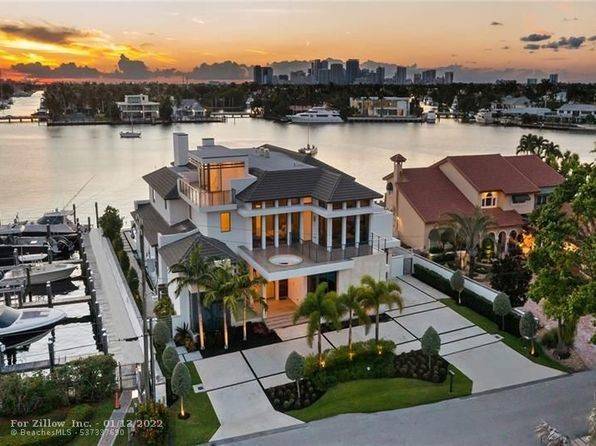

This post was written by Josh Dotoli! Josh is the owner of Josh Dotoli Group which is a laser-focused real estate team at Compass comprised of industry experts selling Fort Lauderdale’s best neighborhoods. This dynamic group is one of the top-selling real estate teams in South Florida with over $94 million in sales in the past 12 months alone. Looking for Harbor Beach Fort Lauderdale homes for sale we are the real estate team for you!